Tips: Buying/Renting

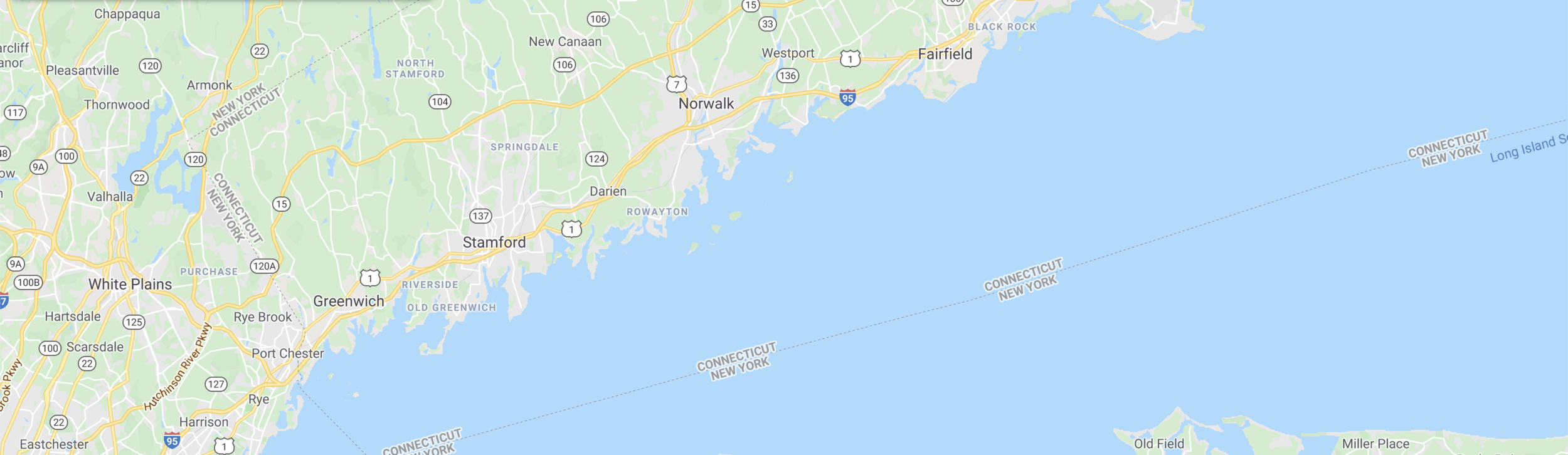

This blog summary focuses on buying, or renting, a house in Fairfield County, CT. Terms and conditions, saving for a down payment, home inspections and more. We’ve got your back!

There are many reasons why we believe buying a home is better than renting, but let's just focus on one — inflation. Yes, right now we are experiencing unusually high inflation, but inflation exists almost always.

Historically low inventory means slim pickings for a new home, right? Not necessarily. Because you don’t necessarily have to replace your current residence with another house. Several exciting new projects offer Fairfield County residents innovative new ways to live. You just have to think outside the “housing” box.

Do you count yourself among the nearly 60 million Americans who are self-employed? Being your own boss has wonderful benefits — flexible hours, freedom in choosing projects/co-workers, control over work environment, ability to pursue your interests/ obtain skills and more. But it also has its downsides, such as proving a steady stream of income.

There is so much emphasis on the frenzy surrounding home buying/selling these days that an important, essential service realtors provide is often overlooked — residential rental assistance. Short-term, temporary while in-between houses, long-term or just for the summer, we can guide you through it all!

It's perfect nowhere. And it isn't even close to perfect anywhere for everyone. What may be bliss to you could quite easily be awful to others. Our best advice is that when you choose where you want to live be extremely selfish. Where you live should work for your needs, likes, wants, and specific individual circumstances.

Did you know The American Society of Home Inspectors (ASHI) was formed by a Stamford, Connecticut builder?In 1973, Ronald Passaro could only identify six other inspectors in the tri-state area.

Throughout this busy year, we received numerous questions and feedback from our clients about their moving experience. Our goal is to help minimize stress from the entire process of buying or selling a home. Hopefully you will find these tips helpful in planning your next move.

We’d like to thank Tom Ayres, Partner at Daigle & Travers Insurance, for so thoroughly explaining why homes are often insured for more that what the homeowners paid for them. Required reading for first-time homebuyers & an excellent refresher for all in these times of ever-rising replacement costs and frequent natural disasters.

We always caution against relying on a "zestimate". Zillow itself claims these to be a "starting point" and encourages buyers, sellers and the just curious to do their own research.

As the saying goes, “nothing is certain but death and taxes”. Yes, no matter where you live in the United States, taxes are a certainty. When considering a move across state lines, it’s important to understate the tax implications. Biased for sure, but we think the “bang for your buck” is a lot better in Connecticut than the surrounding states!

To rent or buy a home isn’t just a financial decision, it’s also about comfort and your vision for your life. When that vision clears and home ownership is in view, will you be ready? As one of the most important financial transactions of your life, you need to make sure your finances are in order before beginning the home-buying process.

A bridge loan is a short-term loan that uses the equity from your current home to help you make an offer on a new one, without rushing to sell. Compass Bridge Loan Services gets you access to competitive rates and dedicated support from industry-leading lenders, with the exclusive option to get up to six months of your loan payments fronted

You found your dream home near the water, but were snapped back to reality upon hearing the words - it is not FEMA compliant. Were you right to panic? Not necessarily, after all you were looking at homes by the water. You always can and should obtain flood insurance - it is just a matter of cost.

Taking steps to improve your FICO® Score can be very helpful before applying for a mortgage or bridge loan because a higher score can help you secure the best terms and interest rates available. Here are some actions that can help improve your score over time…

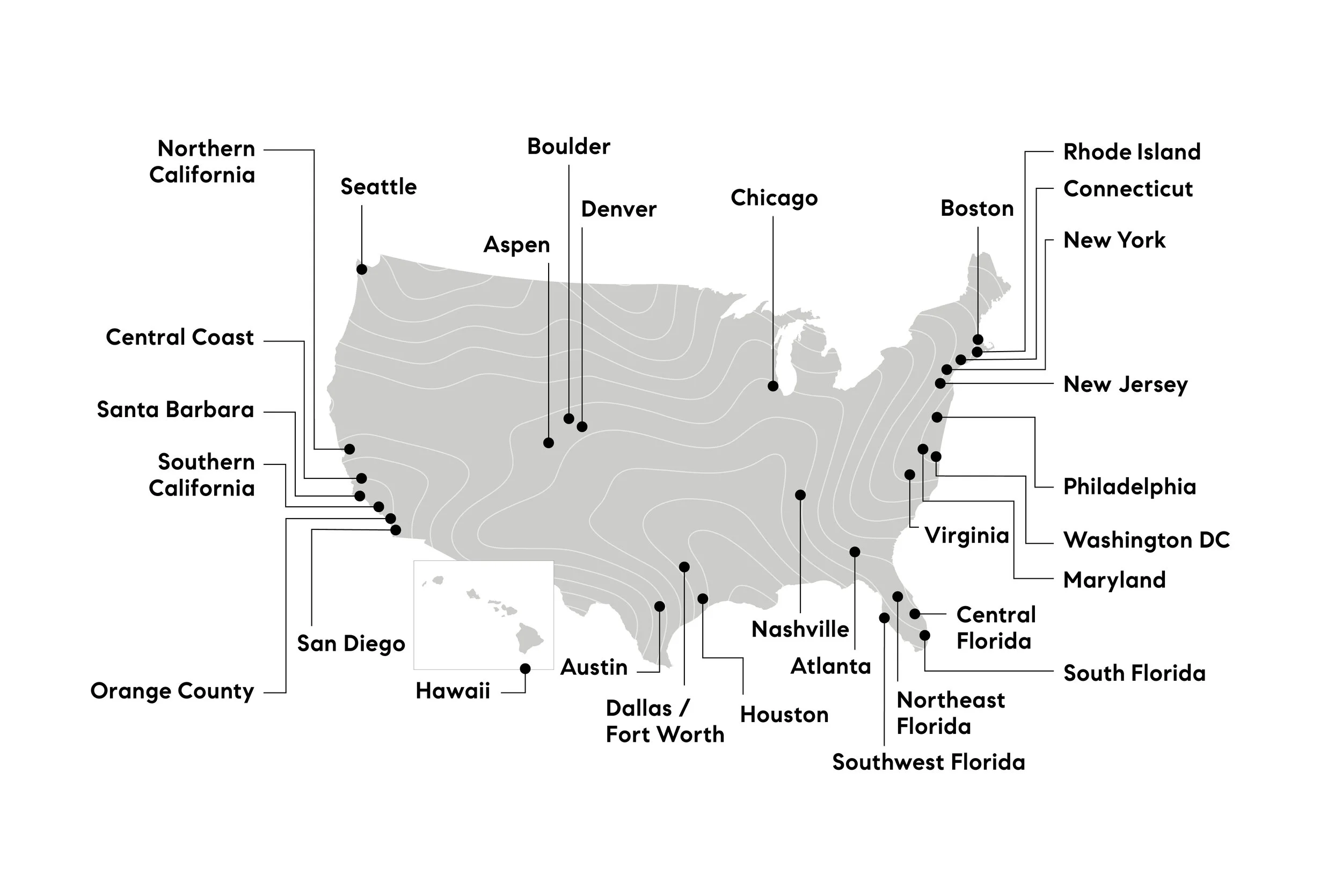

With the KMS Team at Compass you'll get the benefit of years of collective experience in the real estate industry: More ideas, more perspectives, collective marketing ideas, more resources and more negotiation experience.

We’ve got doctors to keep us healthy, financial advisors to grow our money, and lawyers because, well, you know. At KMS Partners, we are advisors in every sense of the word. We are coaches, counselors and therapists. We are there for you when you’re selling and buying -- but even when you’re not ready for a transaction. We’re here to help -- before, during and after a sale. And if you need a referral to a good doctor or electrician: Just ask.

Buying a house is often the most important financial transaction you’ll make in your life. There are many reasons you should trust it to a person, not a pixel. For example, we can help with pricing. Sure, you can find it online. But what does that price mean? Is it fair? What about comparables? Is there room for negotiation? We’re there when you walk through the front door of a house….

The key to a smooth process is to identify a mortgage professional early in the home buyer process who will guide you. A loan officer will help you obtaining a competitive priced loan, he or she will also need to prepare your financial documents in an organized fashion and help you understand the types of products available.

Your friend mentions her house is “broker protected.” Your real estate agent casually mentions “CMA” and “MLS.” You drive by a sign for an “Open House” -- are you invited? Every industry and profession has its own language.